Key Takeaways

- The CBAM is a fundamental mechanism needed to replace the unsustainable scheme of free allowances under the ETS. However, is not a breakthrough tool alone to decarbonize industrial sectors and reach carbon neutrality.

- Because the path for decarbonization for industrial subsectors such as cement and aluminium, will not begin to rapidly scale down before 2035, a slower implementation of CBAM up to 2030-2032 will not prevent industry’s ability to reach net-zero by 2050.

- The CBAM should be implemented in two phases. The first will ensure the implementation of an enforceable mechanism without exacerbating the current burdens carried by industries. In the second phase, the CBAM should expand, allowing for a greater impact from an environmental perspective.

Introduction to the CBAM

Reaching climate neutrality by 2050 requires targeted solutions for different sectors of the economy. For industry, the European Union (EU) is proposing as a cornerstone solution a Carbon Border Adjustment Mechanism (CBAM). If properly designed and implemented, a CBAM would ensure emissions reductions for major industrial subsectors while maintaining the competitiveness of EU industries. In this memo, we outline the status of current negotiations on CBAM in the EU and Carbon-Free Europe’s recommendations to design and implement a CBAM that enables climate commitments but also takes into consideration the current energy crisis.

In 2019 the European Commission unveiled an ambitious European Green Deal, to set up the roadmap for the EU to become the first carbon-neutral economy by 2050. In July 2021, the Commission published an adherent major legislative package to deliver the Green Deal, the Fit For 55. As part of this legislative package, EU institutions are currently discussing the design and implementation of a CBAM.

A CBAM is a long-term solution that aims at limiting carbon leakage by levelling the playing field between domestic and foreign production, through the implementation of a border carbon tax that reflects the domestic carbon price. The CBAM is envisioned by EU institutions as a tool that will support the decarbonization of domestic industries that so far have been granted free allowances under the Emission Trading System (ETS). Sectors at risk of carbon leakage, emission-intensive, trade-exposed (EITE) goods, were afforded special treatment and received up to 100% of free allowances under the ETS. This scheme of allocation clashes with the overall climate objectives of the EU, and it is therefore of pivotal importance that the unsustainable free allocation regime is replaced by an effective CBAM.

Although a CBAM is easy to explain in principle, it is an extremely complicated multidimensional measure and, depending on its design, could raise challenges on legal, technical and geopolitical grounds. Different design elements of the CBAM could introduce challenges from a World Trade Organization (WTO) perspective, whereas others could introduce administrative burdens or create trade frictions. These challenges often interact with one another, creating trade-offs. When analysing different options for design and implementation, it is fundamental to take into consideration the risks at play and the possible trade-offs that they might introduce.

Status of Negotiations

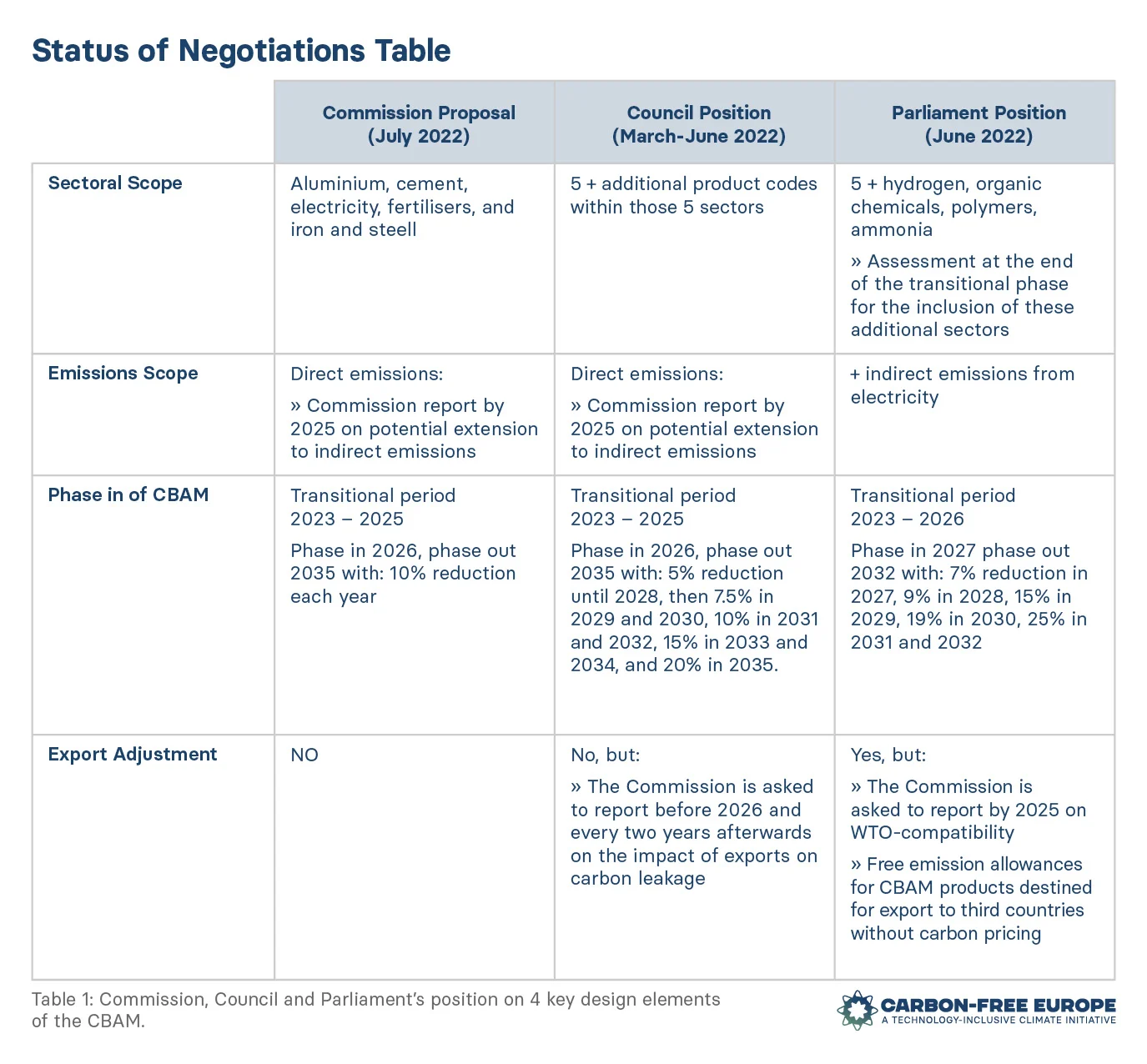

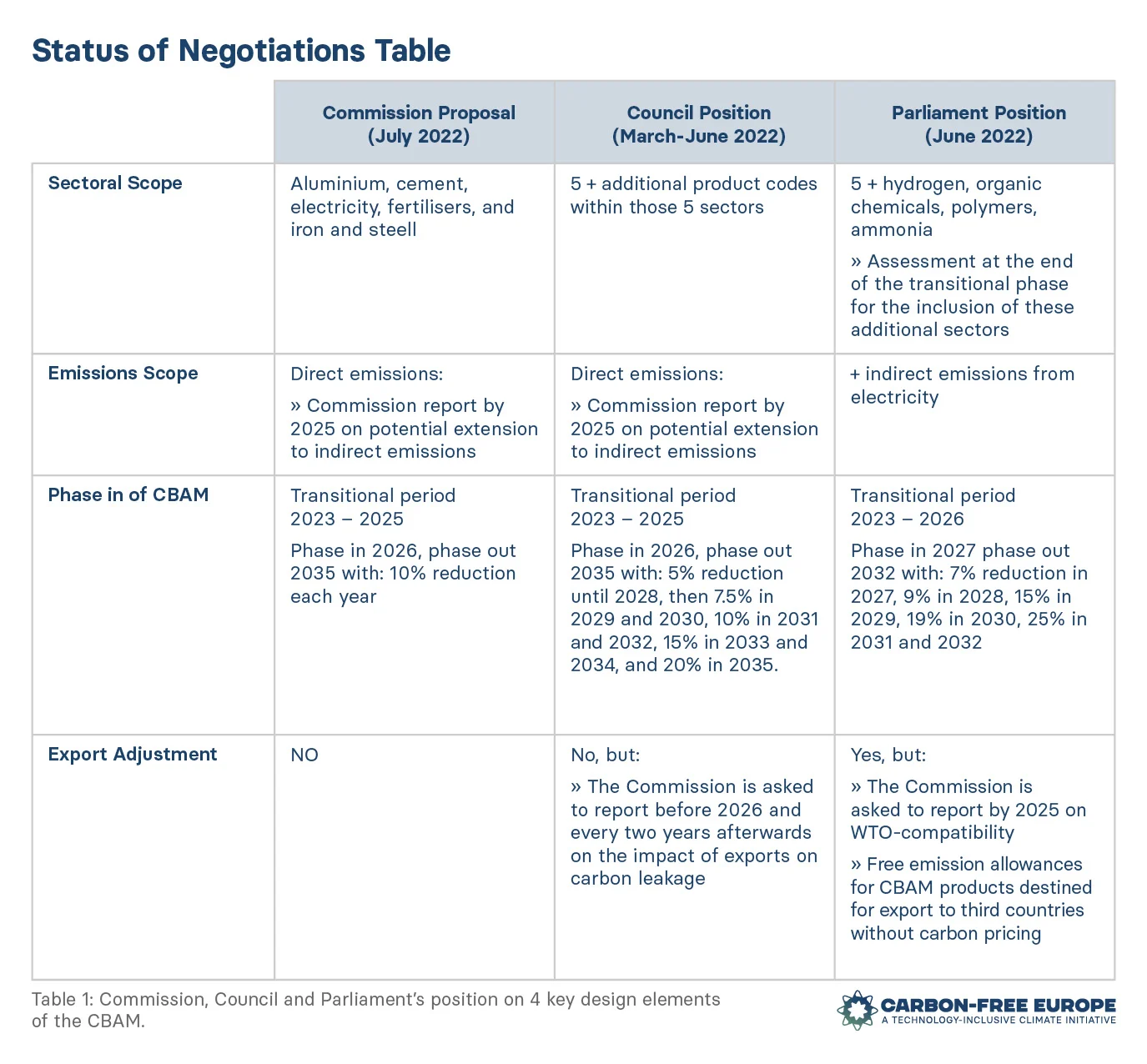

The CBAM proposal is subject to the ordinary legislative procedure which requires both the European Parliament and the Council of the EU to approve the final text. The Parliament and Council have adopted their positions on the Commission’s proposal and are now discussing in the trialogue phase where they will need to reach compromises for the final text, which will then be adopted in national laws. While the respective positions are similar on several elements, they differ substantially on key issues that will be at the heart of the trialogue discussion.

Impact of the Current Energy Crisis

The CBAM discussion falls in a dramatic economic and geopolitical moment. The unfolding of the war in Ukraine, in addition to creating a humanitarian crisis, has also driven up energy prices across the world. Today, Europe is in the midst of an unprecedented energy security and affordability crisis. The emergency has called for several Extraordinary Energy Council meetings. Energy ministers have reached agreements on some elements to address the current crisis and further measures will be taken in the weeks to come to cope with the high energy prices in order to provide some relief to consumers and industries that are carrying the burden of unsustainable costs across the EU.

If we look at specific cases for intensive industries, in the last year, production across the EU has decreased significantly. For the aluminum sector, there has been a 50% reduction in production1with energy costs that are 10 times higher2 and the fertilizer industry is expected to see a 70% reduction by the end of 2022 with 10 fertilizer plants that have already closed by July of 20223.

Today, Europe is faced with a triple challenge: a climate crisis, an energy security crisis, and an affordability crisis. Addressing these different and interconnected challenges entails considering implementing policies that could support one challenge while hindering another. For this reason, it is fundamental to look at two different scales of implementation: the short-term and the long-term. Policymakers are required to find solutions for the energy security and affordability crisis while ensuring the ultimate goal of reaching carbon neutrality by 2050.

CFE’s Position on 4 key Design Elements

Sectoral Scope

The Commission and the Council share the same position of covering a first set of five EITE sectors: cement, iron and steel, aluminium, electricity, and fertilizers. They both also propose an assessment in 2026 for potential expansion of the scope into other sectors. The Parliament is proposing to expand the scope from the beginning to hydrogen, polymers, and organic chemicals as well as downstream sectors by 2030,with the possibility of expanding the scope to all ETS sectors. Although from an environmental perspective, the broader the scope the better, it is important to underline the rationale of the CBAM, which is to tackle carbon leakage. Following this principle, only sectors at risk of carbon leakage should be covered4.

Another important consideration is that countries outside of the EU will be impacted by the CBAM proportionate to their exports to the EU. By expanding the scope of the sectors, there is a higher chance of impacting trading partners, and therefore creating geopolitical frictions. This is fundamental when looking at how the additional sectors will negatively impact the economies of developing countries as well as close EU trade partners such as the US.

Take US exports to the EU, for example. Under the more comprehensive list of the Parliament, an estimate of $21 billion would be impacted in reference to the 2021 trade flows, against $1.4 billion if only the 5 core sectors were to be covered5.

A first phase of implementation with a smaller subset of industries, with the potential to expand in later stages, would allow the EU to tackle a core group of sectors in the short-term, create a mechanism that is more easily enforceable because of the reduced complexity and limit the negative impact on third countries in the initial phase. This scale would ultimately provide time to expand the CBAM to other sectors once the EU has more knowledge and experience with implementation.

Emissions Scope

Similarly, the Commission is proposing to only cover direct emissions (“emissions from the production process of goods over which the producer has direct control”)6, whereas the Parliament is proposing the inclusion of also indirect emissions from electricity (“direct and indirect emissions released during the production of goods and the electricity consumed during the production processes of goods”)7.

A first argument in favor of including indirect emissions is that they often represent a large share of industrial emissions. For example, 84% of emissions in the aluminium sector are indirect and only 18% are direct8. From a climate perspective, the inclusion of indirect emissions is important.

The CBAM needs to mirror the ETS. Since the EU ETS covers emissions from combustion processes to generate electricity, heat and steam, producers that buy inputs from outside their industrial facility, will be faced with charges related to the (ETS) carbon cost that is passed to them through the imports of electricity steam or heat needed to generate their products. This could be used as an argument for the inclusion of indirect emissions as it would not create an unbalance between the CBAM coverage and the ETS, although it is unsure if this would represent an infringement of WTO law.

However, the inclusion of indirect emissions could actually create a disadvantage for EU producers due to the electricity market price at the margin. Indeed, EU producers that have a very clean energy mix may end up paying for a high indirect energy cost because the price is given by the marginal plant i.e., the most expensive plant that is required to serve demand9.

One important thing to be noted is that in the current system, in order to protect industries against these costs of embedded indirect emissions member states can decide to provide for an indirect cost compensation mechanism. The two mechanisms could not coexist, and the CBAM that would cover for indirect emissions would have to then be accompanied with a strategy to replace the existing cost compensation measure.

Finally, from an administrative and technical perspective, including indirect emissions represents bigger complexity.

Eventually, the expansion of the scope to indirect emissions is desirable, however, there are also many issues related to it. For this reason, in the first phase of implementation, the best option is to exclude indirect emissions This would allow for more analysis to be carried out and to find ways to effectively replace the existing indirect cost compensation mechanism while giving time to the EU’s grid to decarbonize.

Phase in of CBAM

Perhaps the most sensitive question around CBAM design is the timeline and schedule for phasing out free allowances under the ETS while phasing in the CBAM. With industries facing uniquely astronomical energy prices, additional costs could have severe impacts on the ability ofindustrial facilities to continue production. The options on the table vary significantly, with the Commission envisioning a gradual implementation over the period of 10 years, the Council envisioning a slower implementation until 2030 and a faster implementation up until 2035 within a 10 year period, and the Parliament envisioning a full phase out by 2032 with a more rapid phase out scale from 2030.

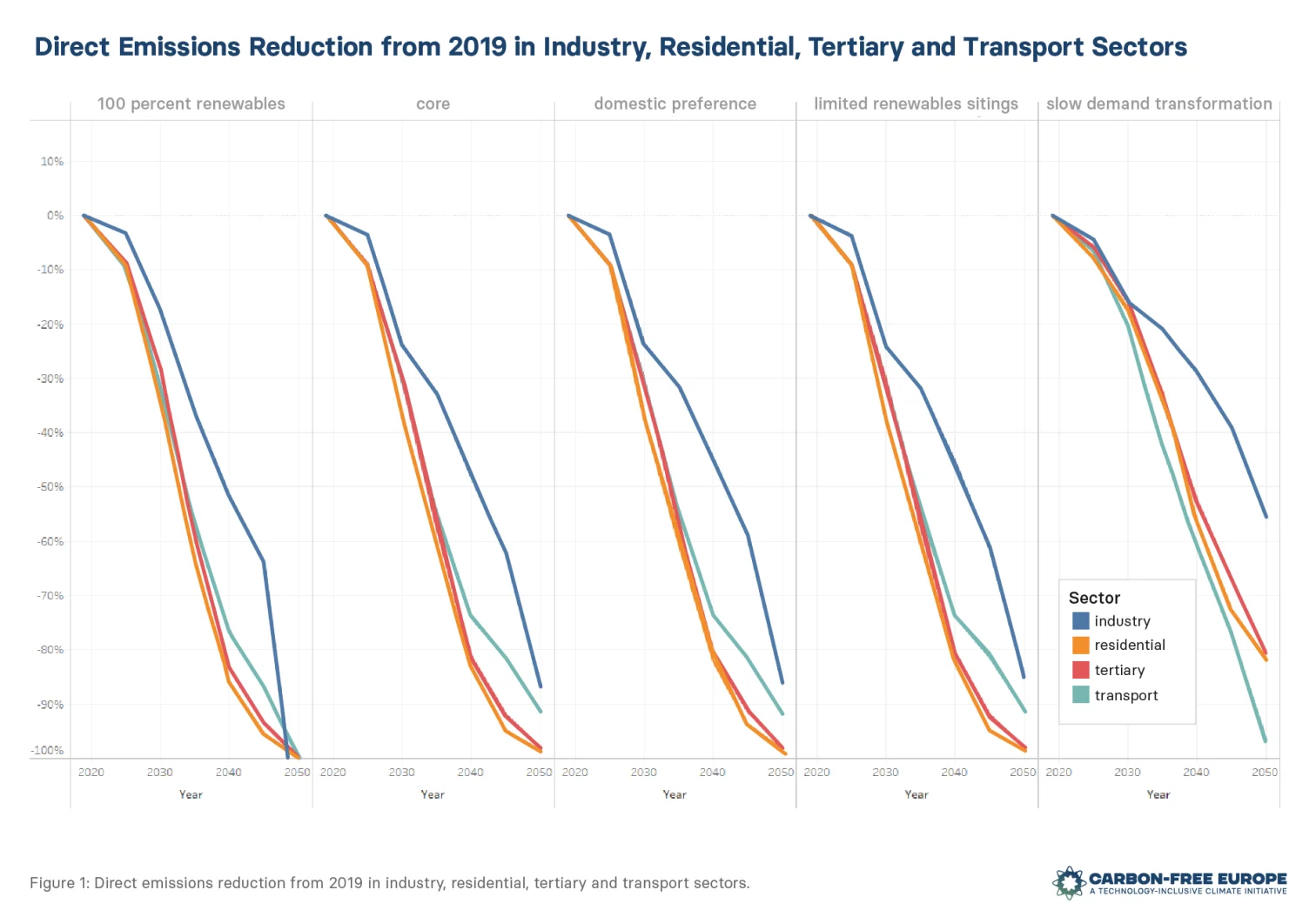

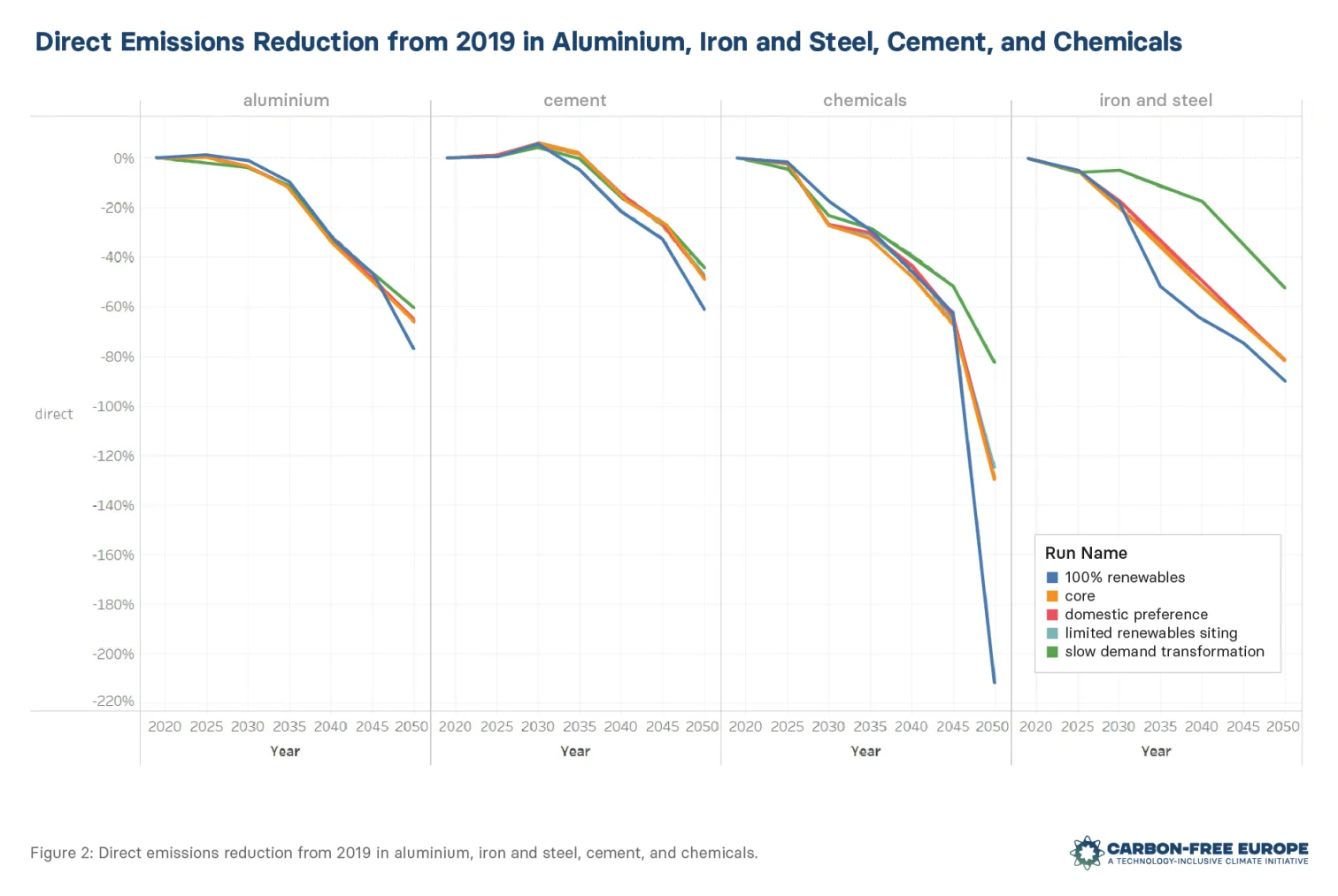

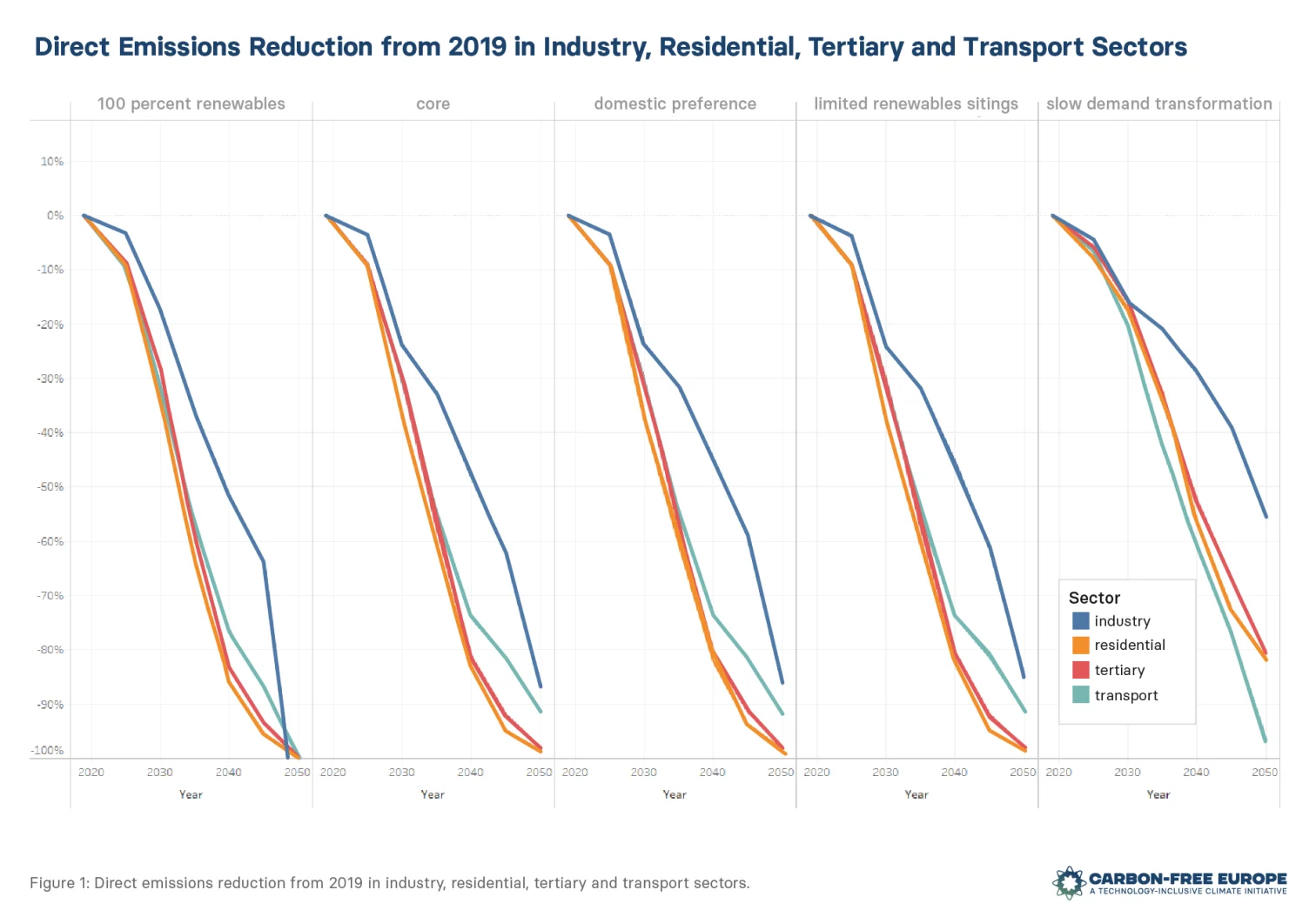

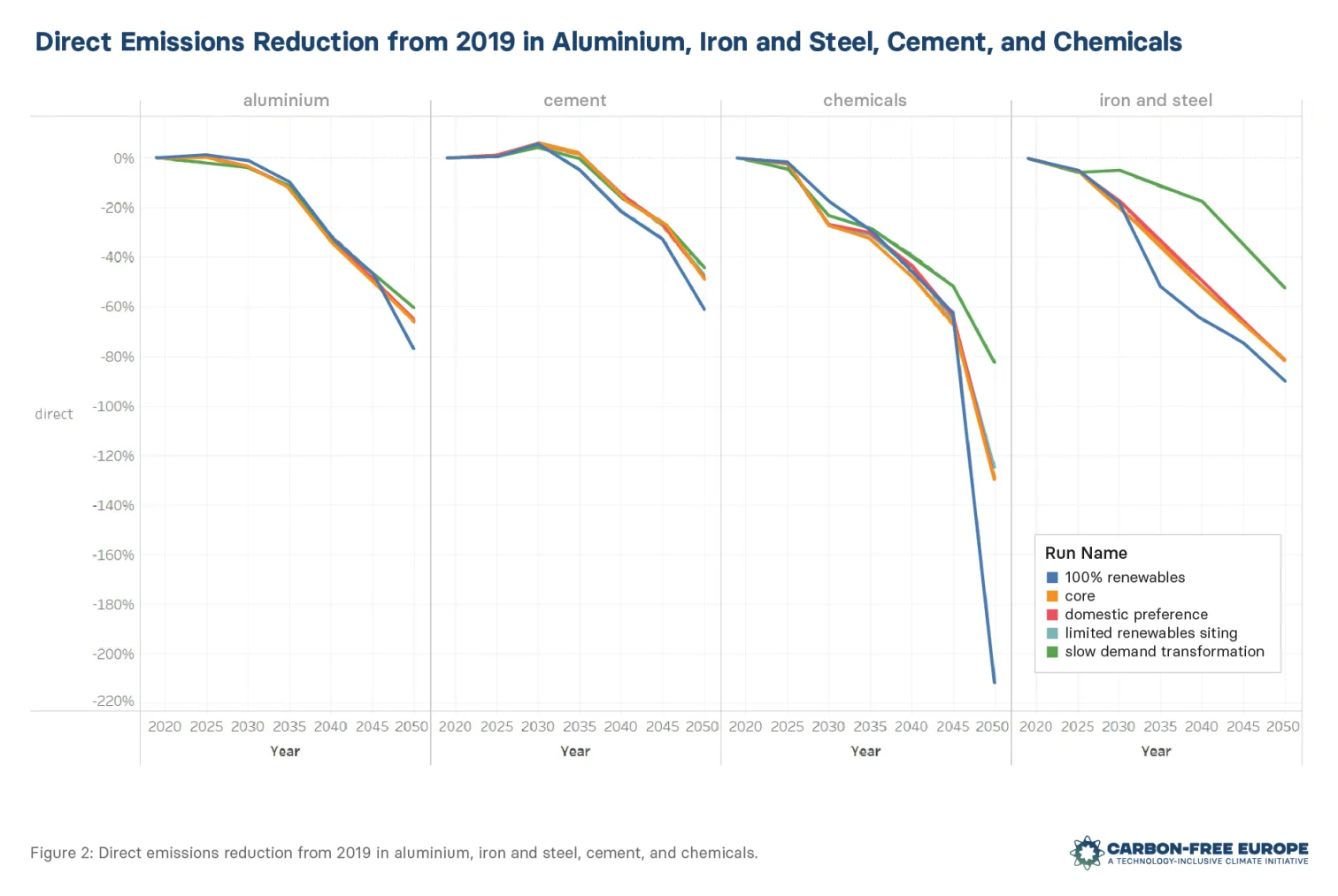

Decarbonization pathways for the industrial sector suggest that most progress this decade will depend on electrification while simultaneously investing in the innovation and deployment of next- generation technologies than can tackle parts of industry that cannot be electrified. In the 2030s and 2040s, industrial emissions will be reduced with innovative clean energy (See Figure 1).Given the trajectory for industrial emission reductions (See Figure 2), full implementation of the CBAM by 2032 versus 2035 will unlikely impact the EU’s ability to decarbonize the industrial sector by 2050. The phasing out of free allowances is a fundamental step in order to incentivize a sustainable transformation, however, a more rapid timeline is unnecessary to ensure net-zero by 2050. A faster timeline could also exacerbate the current burdens on industries.

As mentioned above, new clean energy technologies will play an important role in decarbonizing industries. So a CBAM policy should also be accompanied by policies to support the innovation and deployment of a diversity of clean energy technologies. Because heavy industries operate in long investment cycles (20-30 years), the next years are fundamental to kick-start the large-scale deployment of breakthrough technologies that will then represent a major push along the phase out of free allowances to decarbonize the industrial sector.

Export Adjustment

Neither the Commission nor the Council envision the implementation of some type of export mechanism. On the other hand, the Parliament is proposing a system in which companies continue to receive free allowances for the products that they export to ensure competitiveness in foreign markets that have no carbon pricing mechanisms. The rationale behind export mechanisms is that without it, there would be a risk of carbon leakage. This would result in the loss of competitiveness of EU industries in global markets that would be replaced by more intensive products from jurisdictions with no stringent climate policies.

Export mechanisms have been triggering a lot of discussion around WTO compatibility in reference to the rules on prohibited subsidies outlined in the Agreement on Subsidies and Countervailing Measures (ASCM). Specifically, it could be argued that this mechanism is providing an unfair advantage to EU products in the global market. Because of the complexity of determining whether the CBAM represents a prohibited subsidy is important to assess the compatibility with trade rules prior to the implementation, as suggested by the proposal of the EU Parliament.

There are good arguments for both positions. However, in tandem with the phase in of the CBAM and the subsequent phase out of the free allowances, there is the opportunity to link the two policy designs so that, only when free allowances are substantially phasing out and therefore the risk of carbon leakage becomes more relevant, then an export mechanism could be implemented to protect the competitiveness of domestic industries.

Conclusion

Today the CBAM discussion falls in a very different economic and geopolitical environment compared to the Green Deal’s announcement in 2019. Europe is faced with an unprecedented energy security and affordability crisis, that has forced already many industries to shut down or reduce production. Although the ultimate goal is and will remain the decarbonization of the industrial sector by 2050, in the short-term it is fundamental to implement policies that do not exacerbate the current crisis.

The CBAM should be viewed in this framework as a necessary tool to replace the unsustainable free allowances scheme under the ETS, and as a long-term solution that however, is not a breakthrough tool alone. Only if paired with policies that support the innovation and deployment of clean energy technologies, the EU will be able to achieve the decarbonization of the industrial sectors and reach carbon neutrality by 2050.